In Oct 2022 RBI have issues a concept note for a new Central Bank Digital Currency (CBDC) for India. CBDC is a digital form of currency notes issued by a central bank and RBI referred to it as e₹ (digital Rupee) or e-Rupee which is equivalent to physical cash but in a digital form. The e₹ or e-Rupee is aimed at providing an additional option to the currently available forms of money. The Reserve Bank of India has announced the launch of the first pilot for retail digital Rupee (e₹-R) on December 01, 2022 and the full phase implementation will give India its very own Digital Currency. Lets know what is this new digital currency is all about, how it works and how its going to change the way we do day to day transactions.

What Is CBDC?

CBDC or Central Bank Digital Currency are a new variants of central bank money different from physical cash, that means the central bank is liable for these CBDCs. The Reserve Bank of India defines CBDC as “the legal tender issued by a central bank in a digital form which is the same as a sovereign currency and is exchangeable one-to-one at par (1:1) with the fiat currency.” In India Digital Money is not new and we all are now very acquainted by the terms digital wallet, UPI, virtual account, etc, but CBDC would differ from existing digital money as it would be a liability of the The Reserve Bank, and not of a commercial bank. Some of the unique features of CBDC as defined in RBI Concept Note on Central Bank Digital Currency are,

• CBDC is sovereign currency issued by Central Banks in alignment with their monetary policy

• It appears as a liability on the central bank’s balance sheet

• Must be accepted as a medium of payment, legal tender, and a safe store of value by all citizens, enterprises, and government agencies.

• Freely convertible against commercial bank money and cash

• Fungible legal tender for which holders need not have a bank account

• Expected to lower the cost of issuance of money and transactions

What is the e₹ (e-Rupee)?

In simple terms, Digital Rupee or digital currency or e-Rupee is a digital form of cash/paper money or CBDC to be issued by RBI. as explained above it will be equivalent to physical cash, that means 1 digital Rupee is equal to ₹ 1 cash. Digital Rupee or digital currency or e-Rupee could be wholesale and retail and RBI have just launched the pilot for the retail CBDC in select cities.

Is e-Rupee a cryptocurrency?

The straightforward answer to this is No. Digital Rupee and cryptocurrency are two different technologies and are in no way linked to one another. Cryptocurrency is based on blockchain technology, but digital Rupee is basically a Central Bank Digital Currency (CBDC) which is issued in forms of digitized token.

Another major difference between the two would be that while cryptocurrency market linked digital currency, the e-Rupee would be guarantied by the Central Bank and the value remains the same just like the cash.

How will the e₹ (e-Rupee) Work?

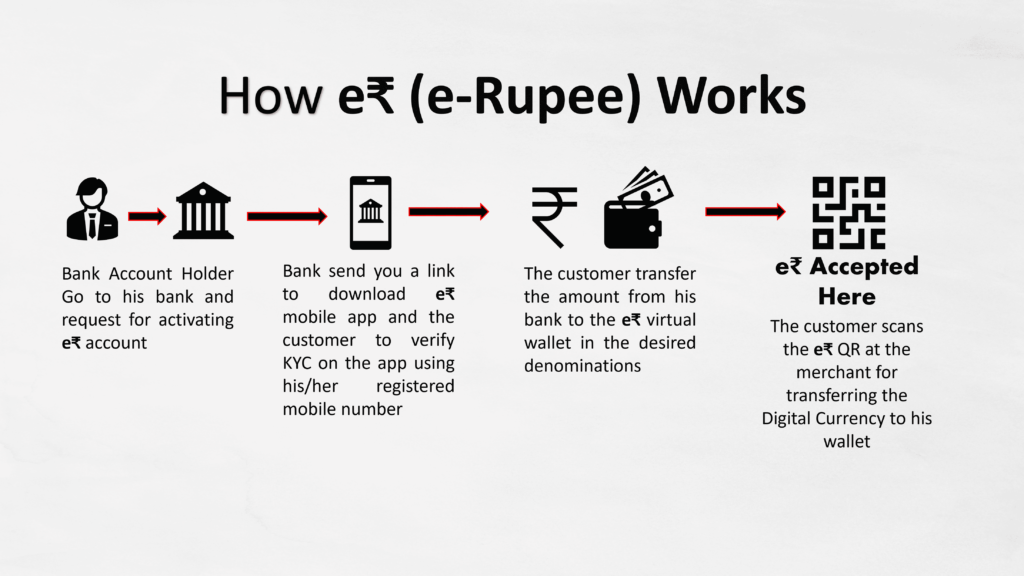

It will be just like spending the physical cash for any transaction, but not from a physical wallet. The digital wallet in this case would be issued by any of his bank through a separate e-Rupee app. To be able to use the Digital Currency, bank account holder go to his bank and request for activating e₹ account. The bank then sends you a link to download e₹ mobile app and the customer to verify KYC on the app using his/her registered mobile number.

Once the digital wallet is issued to the customer he/she can transfer the amount from his bank to the e₹ virtual wallet in the desired denominations. Suppose the customer want to convert ₹ 10,000 to digital form, then they can choose to take this as 500*20 or 100*50 + 500*10 or any other combination of their choice.

To use the e₹ (e-Rupee) the customer scans the e₹ QR at the merchant for transferring the Digital Currency to his wallet and complete the transaction. These converted digital currencies will not earn interest when parked in the e-wallet as it is just equivalent to possessing the physical cash.

Why is the Govt and RBI interested to issue e-Rupee?

Physical currency and coins brings a lot of challenges and cost in terms of its printing, storage, distribution and security. If RBI could replace some of this cash with digital currencies, that could save a lot of money of the Govt treasury. The digital currency is also targeted at those who don’t have a bank account, but can use digital currencies similar to a pre-paid mobile recharge card even without a smart phone in coming days as the technology behind CBDCs evolve.

If we think from a technological point of view such CBDCs or Digital Rupees, also bring a challenge of issuing separate tokens for separate denominations, that to for each user making it more complex that it seems. But it has some technological advantages too, as this digital money can be programable, and every transactions can be tracked that RBI is not yet talking about.

How I will be benefited from e-Rupee?

Suppose you want to transfer huge sum of money from your account to another person. Traditionally with NEFT/RTGS to transferring money to a new account you need to first add the beneficiary and wait for few hours to transfer money. Secondly bank may also put restriction to the transactions as per their policy and need to clear it from their end to successfully complete the transaction.

However, with digital rupee you can send money to any person (to his e-Rupee wallet) instantaneously as money is stored in your wallet and there is no role of bank to authorize these transaction. It would be just like handing over cash to another person. But it does not mean that RBI or Govt. will ignore such transactions, as RBI may impose some restriction on digital rupee loading as in the case of cash withdrawal.

In a day to day scenario end users would be able to have the freedom from roaming with physical cash for any transaction, nor have to give frequent visit to ATMs. On the other hands commercial banks will have some reduction in administrative work.

The transaction in Digital Rupee or e-Rupee can happen in two modes namely Person to Person (P2P) and Person to Merchant (P2M).

Will e-Rupee replace UPI and How is it different from UPI?

Govt or RBI have no such intentions to stop UPI as it is a completely different mode of transaction which is bank-to-bank and works on a settlement basis between two banks.

As UPI works on settlement basis and involves a lot of intermediary in between, there is a settlement risk in UPI and transactions may fail. e-Rupee is issued directly by RBI through banks and transactions are wallet to wallet and instantaneous.

UPI also leaves a transaction or audit trail that can be verified, but in case of digital currency these are tokenized on the end users devices and audit trails can’t be recorded as in UPI.

Currently UPI is free, but could become chargeable going ahead as banks are paying third party charges for such transactions. But in case of digital currency or e-Rupee there would not be any charges as there are basically cash transactions guarantied by RBI.

In case of UPI your money is stored in your bank account earning an interest, but with digital currency there is no such interest as it is a replacement of cash. So persons who does not use much cash would continue to prefer UPI over e-Rupee.

From a use case prospective UPIs are more convenient to various use cases, offer interoperability with multiple applications, created instantly and have been widely accepted throughput the country. e-Rupee fist need to establish itself in the market in terms of ease of use, stability and reliability just like UPI to be widely accepted.

Future of e-Rupee in India

No doubt the introduction of CBDCs is a welcome move by RBI and it will be the backbone for future Digital Economy. But with the launch of the pilot phase there would be a lot of learning and if we tastes success, we may see a new revolution after UPI in India. We also await to see how this technology can be access by rural population still deprived of a smartphone.

Further Readings and References:

- RBI Concept Note on Central Bank Digital Currency

- https://www.thehindubusinessline.com/blexplainer/bl-explainer-rbis-e-rupee-versus-upi/article66213758.ece

- https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1218

- https://en.wikipedia.org/wiki/Digital_Rupee

- https://www.indiatoday.in/technology/features/story/digital-rupee-launched-in-4-cities-how-to-buy-and-use-5-important-questions-answered-2304183-2022-12-01

- https://finshots.in/archive/what-is-e-rupee/